9 Min Read

Credit Card Fraud: What It Is & How Businesses Can Stop It?

Table of Content

Download Paymattic – it’s Free!

Subscribe To Get

WordPress Guides, Tips, and Tutorials

We will never spam you. We will only send you product updates and tips.

Credit card fraud.

Sounds scary. Right?

Digital economy, totally depends on credit card transaction method that you can’t ignore. Millions of payments are processed daily through credit card transactions, which makes life more convenient, but they also come with risks of fraudulent transactions.

Credit card fraud is more than just a financial threat for both consumers and businesses, it can shatter customer trust, leading to long-term damage to a brand’s reputation. That’s why it is crucial to understand credit card fraud and take proactive steps to prevent it. Moreover, you must be aware of online payment security to avoid this circumstance.

In this article, we’ll explore credit card fraud and provide actionable strategies businesses can use to safeguard against it.

Before going deeper, let’s get some basic ideas about online payment security.

Online payment security – at a glance

Credit card fraud can occur when your business lacks sufficient online payment security. As a business owner, you must implement strong processes that secure your customers’ financial transactions, personal information, and card data, this is the core of online payment security. This security system ensures safe, fraud-free payment processing through encryption, secure connections (SSL/TLS), multi-factor authentication, and compliance with standards like PCI DSS.

If customer privacy isn’t protected and fraud occurs, it could lead to legal repercussions, financial losses, and damage to the reputation of your company.

What is credit card fraud?

Credit card fraud refers to unauthorized use of someone’s credit card or credit card information without the owners’ concern. Suppose you have a credit card, but someone gets hold of your card details without your permission, withdraws funds, or makes a purchase in your name, this type of fraudulent activity falls under credit card fraud.

Since online payment, this risk can be even greater as it doesn’t require any physical use of credit cards, so fraudulent can steal the card information of others and make a purchase online. Not only that, hackers trick users into providing card details through fake websites or emails that mimic legitimate brands.

How credit card fraud affect buisness?

Credit card fraud can harm both business owners and consumers, so preventing fake credit card is crucial for ultimate success. It can lead to financial losses for individual cardholders through unauthorized transactions and also cause business financial losses from chargebacks, penalties and a downgrade in brand reputation. Now, your question can be ‘how can I protect my buisness from credit card fraud?’

To get relief from this crisis, business owners must take preventive measures, such as encryption, multifactor authentication, and real-time fraud detection. Also, businesses can stop credit card fraud by implementing secure payment gateways and using real-time fraud detection tools.

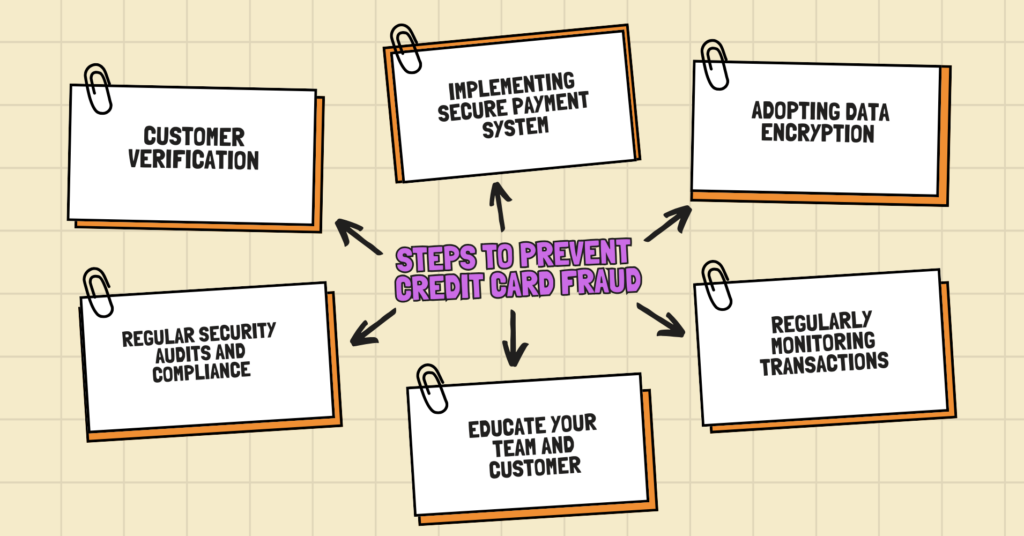

How to prevent credit card fraud for online business?

Now that you have ideas about online payment security and credit card fraud, let’s talk about how to prevent credit card fraud for businesses. Here are 6 key steps that your business can take to stop credit card fraud:

- Implementing a secure payment system

- Adopting data encryption

- Regularly monitoring transactions

- Educate your team and customer

- Customer verification

- Regular security audits and compliance

Implementing secure payment systems

Choosing a payment processor with a prebuilt fraud protection feature is an important step for businesses to prevent credit card fraud. The security of your payment system should be your top concern as you are receiving online payments and sensitive customer data. You must ensure your selected payment gateway and payment method are from a reliable company and declare the security measures it uses to protect your payments.

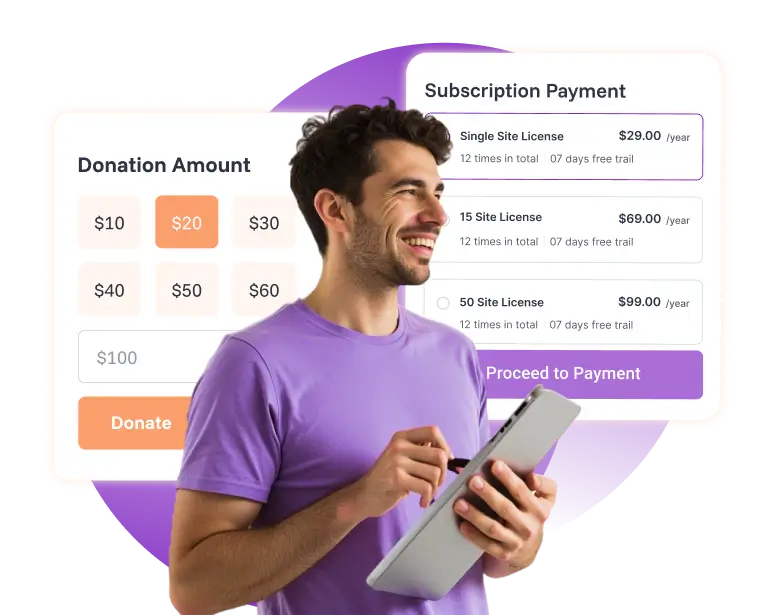

Payment plugins like Paymattic offer credit card fraud protection features like encryption, multifactor authentication, and real-time monitoring to detect and prevent fraudulent transactions. The plugin allows you to create payment and donation forms with built-in spam protection. It protects from WordPress spam with reCAPTCHA, Cloudflare, and Honeypot; these are the most frequently encountered spam protection tools.

On top of that, it integrates with Stripe, PayPal, Square, and 11 other trusted payment methods, so you can collect funds for your business without boundaries.

Adopting data encryption

We already mentioned the importance of protecting your customers’ sensitive data. Data encryption is a part of this. It’s a system of encoding payment details so that only the person who holds the encryption key can decode them. It can ultimately help save your customers’ data and secure their accounts from unauthorized access.

TLS (Transport Layer Security) and SSL (Secure Sockets Layer) are two data encryption protocols that protect sensitive information, such as account login credentials and credit card numbers. They ensure data is securely transferred between servers and customers and prevent unusual access.

Get a TLS or SSL certificate from your hosting provider and follow their instructions to activate it on your WordPress site, to ensure a safer internet experience for users.

Subscribe Newsletter

Subscribe to our newsletter for updates, exclusive offers, and news you won’t miss!

Regularly monitoring transactions

The sooner you can identify suspicious activities happening on your online store, the better you can resolve them. As a business owner, regularly monitoring transactions is a part of your duty. At the end of the day, you need to cross-check the purchase details of your online store.

A larger number of purchases may not always be a sign of fraud, but a large purchase that happens several times a day from the same address may be reason to think. Additionally, you can also keep in mind the high sales amount, customer overpaying, or any abnormal number of international orders.

Use a tool that can detect suspicious activity, such as unusual IP addresses or sudden large purchases, to catch fraudulent activities at an early stage.

Online Payment Security Handbook

A SAFETY CHECKLIST TO PROTECT YOUR ONLINE PAYMENT

It’s undeniable that a good UI thinks about people who are somewhat biologically challenged. Accessibility is a core part of our design and development.

- Online Payment

- Online Payment

- Online Payment

- Online Payment

Educate your team and customers

Training your staff before taking over their duties. If you run an online business and receive payment online, your employees must know how to detect fraudulent transactions to prevent them.

For example, trained in data privacy protocols, phishing attempts, or identifying fake IDs, to block fraud before it happens. Regularly hold sessions on fraudulent activities and suspicious transactions.

Once security measures are in place, provide tips to your customers about safe online transactions, such as avoiding public Wi-Fi and not saving card information on every e-commerce site while making payments.

Customer verification

When customers attempt to make payment for the purchase, verify authentic transactions with multifactor verification. Ensure that only an authorized person can make a purchase and access account information.

Businesses can implement verification methods, such as (MFA) Multi-Factor Authentication, which has several steps to identify confirmation, (AVS) an Address Verification System to check the authenticity of the billing address, or (CVV) a Card Verification value that ensures customers also physically access the card.

Another one is geolocation tracking. It also helps to identify suspicious transactions based on location discrepancies. These steps are enough to catch fraudulent activities and protect customer data.

Regular security audits and compliance

Regular review and update of security protocols, which also includes compliance with standards such as PCI DSS (Payment Card Industry Data Security Standard), should be part of the business’s activities to stay ahead of evolving fraud tactics.

Check unusual activities by reviewing your security logs regularly to catch any suspicious login attempts or file changes. Use tools like Wordfence or Sucuri Security to block attackers looking for vulnerabilities on your site.

Paymattic: A trusted payment solution

It’s no matter whether you are running a business or raising funds for charity, you will need a reliable payment solution that won’t lose your money.

If you ever do research for the best payment plugin, you must find Paymattic in the list. It is the ultimate plugin for WordPress users to collect payments and donations online.

Paymattic offers businesses and non-profits a secure and efficient way to manage payments and donations, integrating seamlessly with WordPress to ensure a reliable transaction experience. Designed with multi-layered security, Paymattic protects both businesses and their customers by preventing unauthorized access and minimizing fraud risk. With trusted integrations across major payment gateways like Stripe, PayPal, Mollie, and 11 others, Paymattic is tailored to meet the highest security and functionality standards.

Benefits of Choosing Paymattic for Fraud Prevention

Now let’s see the benefits of choosing Paymattic for fraud prevention.

- Paymattic provides multi-layer security to protect your payment and donation form to protect from spam.

- To ensure your security, it’s integrated with all reliable payment method that has the capability of preventing fraud protection.

- Its real-time monitoring capabilities allow businesses to catch suspicious transactions early, allowing businesses to swiftly prevent fraud.

- Its built-in verification process ensures authorized access and legitimate transactions.

- It secures user data under strong encryption standards that prevent exposure to data breaches and identify fraud.

Paymattic is the obvious choice if businesses want to tap into the establishment. Moreover, it’s a reliable payment infrastructure with a strong focus on fraud prevention and high customer trust.

Protect your business from credit card fraud

That’s true; you can’t prevent all fraudulent activity in an online transaction, but with the necessary steps, you can be aware of the risks of accepting credit card payments. Be sure the tools you use to receive payments are safe and secure. Otherwise, you will lose both the customer’s trust and brand reputation.

You are fortunate enough if you are using Paymattic for your business online transactions because it has the capacity to provide your company with a safe and reliable payment experience. If you’r not using Paymattic yet and want to try it now, then don’t miss our ongoing discount. Grab it at a cheaper price.

Hope this article may help your business to prevent credit card fraud, comment below if I miss something that you want to know.

Have a good day.

Ciao!

Join the thousands already enjoying Paymattic Pro!

Leave a Reply