17 Min Read

Payment Gateway vs. Payment Processor [Spot The Differences]

Table of Content

Download Paymattic – it’s Free!

Subscribe To Get

WordPress Guides, Tips, and Tutorials

We will never spam you. We will only send you product updates and tips.

Summary: Payment Gateway vs. Payment Processor

A payment gateway and a payment processor work simultaneously but serve separate parts of the transaction. The payment gateway collects and secures payment data, and the payment processor authorizes and completes the transaction.

The payment gateway takes care of the customer’s side, where they enter their credit card information. It encrypts the data and securely transmits it to the payment processor.

The processor checks whether payments are valid and relays messages between banks to make sure money moves. Gateways deal with transmitting data securely, while processors manage authorizations, fraud detection, chargebacks, and settlements.

If you’re running an online business, you’ve likely heard “payment gateway” and “payment processor” thrown around in debates like payment gateway vs payment processor.

These terms can confuse e-commerce owners. But they are key to smooth, secure transactions for your digital customers.

A payment gateway is the secure spot on your site where customers enter card details. It checks if the card is valid. A payment processor then sends that data to card networks, issuing banks, and acquiring banks to get approval and funds.

Together, they involve four main players:

- You

- The customer

- Your bank

- Customer’s bank

Understanding their roles will help you pick the right tools for reliable online payments.

In this article, I’ll cover the main differences between payment gateways and payment processors, their roles in transactions, how they work together, and how you can choose a payment gateway and payment processor for you.

So, let’s get started.

What is a Payment Gateway?

The main task of a payment gateway is to capture and transmit the payment information from your customers to the payment processor. Picture it as the digital version of card terminals at physical stores.

When someone types their credit card number, expiration date, and CVV on your checkout page, the gateway immediately encrypts that sensitive data using the SSL or TLS protocols. And then sends this encrypted data to the payment processor. This protection keeps hackers and thieves away while data travels across the internet.

The payment gateway validates the card info to confirm it looks correct. It runs basic fraud checks for anything suspicious. Then it sends encrypted data to the processor for real authorization. After the processor communicates with banks and card networks, the gateway receives word about approval or decline. The gateway updates your website or app, so customers see the right message.

Different gateway types exist for different needs. Hosted gateways redirect customers to a separate secure page for payment entry. Integrated gateways let customers check out on your site without leaving. API-hosted gateways give developers room to customize while maintaining security.

Top payment gateways

Some of the best payment gateways available in the market are:

Stripe

Stripe is one of the most popular payment gateways out there. It bundles both a payment gateway and payment processing, which explains its huge popularity.

Stripe comes with clean developer tools, customizable Stripe checkout experiences, and straightforward integration. And it supports multiple payment methods, different currencies, and subscription billing.

PayPal

PayPal is another massively popular payment gateway to manage transactions. Millions of consumers trust PayPal’s payment gateway. PayPal offers one-touch checkout and buyer protection. It also works in countless countries and supports over 25 currencies.

Square

Square connects gateway and POS systems seamlessly. Got both online and physical stores? This is ideal. Unified commerce ties everything into one system.

Authorize.Net

Authorize.Net functions as a dedicated gateway working with over 20 processors. This flexibility lets you choose your processor while using their secure gateway. Authorize.Net comes with years of reliability and solid security features.

Adyen

Adyen offers an enterprise-level gateway with processing power. The global platform accepts payments from anywhere through one-touch integration. Since Adyen controls the whole payment flow, you get incredibly rich data insights.

Braintree (PayPal-owned)

Braintree accepts credit cards, debit cards, digital wallets, and even cryptocurrency. It comes with great mobile payment solutions and strong fraud protection.

What is a Payment Processor?

A payment processor handles the actual movement of money when someone buys from you. Think of it as the middleman connecting your business, your customer’s bank (the issuing bank), and your bank (the acquiring bank).

This is how a payment processor works – your customer makes a purchase, and the processor gets the transaction data. It reaches out to card networks (Visa, Mastercard, American Express, or Discover) and forwards everything to the customer’s bank. The bank needs to verify that funds are available and that nothing looks suspicious.

The bank reviews the request and makes a call. They check account status, available balance or credit, and run fraud checks. Once they decide, they send their answer back through the card network to the payment processor.

When everything’s approved, the processor starts payment settlement. It coordinates moving money from the customer’s bank to your merchant account. You’re usually looking at one to three business days for this. The processor takes care of clearing, reconciliation, and payment timing.

But there’s more to payment processors than moving money. They provide fraud detection tools, help you deal with chargebacks, keep you compliant with regulations like PCI DSS, and give you detailed reports to track your transactions.

Top payment processors

A few big names run the show in payment processing. Here are some major players:

Stripe

Developers love Stripe. It supports over 135 currencies and has powerful API features. John and Patrick Collison started it in 2010, and it’s now the second-biggest payment processor after PayPal. Stripe can handle everything from subscription billing and one-time payments to international transactions.

PayPal

PayPal is huge. It’s in over 200 markets and lets customers pay with their PayPal balance, credit cards, or bank accounts. When you want instant customer trust, PayPal’s your answer.

Square

Square shines when you need both online and in-person payments. You get point-of-sale systems, card readers, and online checkout in one package. Small to medium businesses love it, especially retailers and service providers.

Adyen

Adyen serves the big players. This Netherlands-based company combines processing and acquiring, with over 100 local payment methods across 60+ countries. Whether customers shop online, on mobile, or in stores, Adyen keeps everything unified.

Authorize.Net

Authorize.Net has been around for years with a strong reputation. Good security, tons of payment methods. Visa Inc. owns it now, and it handles both gateway and processing.

Subscribe Newsletter

Subscribe to our newsletter for updates, exclusive offers, and news you won’t miss!

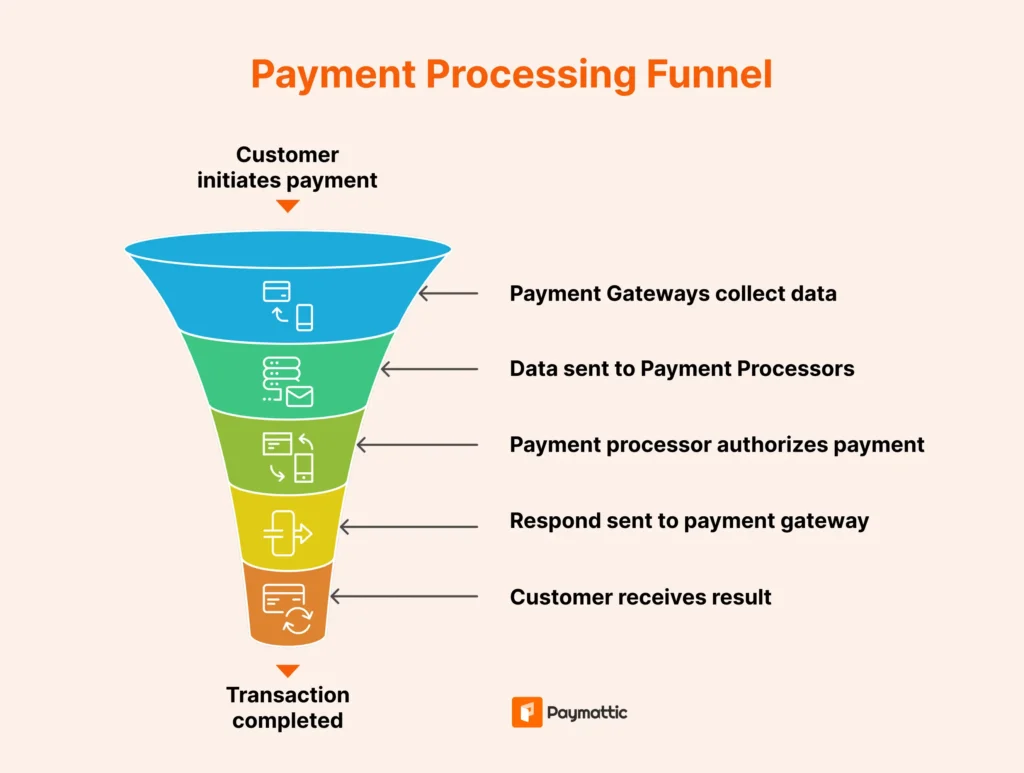

The role of each in a credit card transaction

Let me walk you through what happens when someone clicks “Buy Now” on your site. This shows exactly how gateways and processors work differently.

Your customer decides to buy and heads to checkout. They enter payment info (card number, expiration date, security code) into your site or app form. And then –

Step 1: Payment Gateway captures payment data

The payment gateway is your first touchpoint. It captures the sensitive payment data and encrypts it with secure protocols.

Then the payment gateway verifies that the card number format looks right and runs quick fraud checks. Then it packages encrypted info and sends it securely to the processor.

Step 2: Payment Processor routes to Card Network

The processor receives tokenized data from the gateway and takes over. It sends transaction details through the appropriate card network (Visa, Mastercard, American Express, or Discover) to reach the customer’s bank.

Step 3: Bank reviews requests

The bank examines the authorization request. They verify card details, check that sufficient money or credit exists, and evaluate whether the transaction seems sketchy. They either approve it or shut it down.

Step 4: Response returns through Card Network

The bank sends its decision back through the card network to the processor. The processor passes the authorization response to the gateway. The gateway updates your website, and customers see success or decline messages.

Step 5: Customer sees confirmation

Approved transactions show confirmation, and you can fulfill orders. Money gets held in the customer’s account.

The whole process takes seconds from the customer’s view. Gateway handles secure data transmission, while the payment processor manages verification and money movement.

How do payment processors and payment gateways work together?

Payment processors and payment gateways team up for smooth transactions. They get money safely from customer accounts to yours while protecting sensitive info.

Think of the gateway as the messenger and the processor as the executor. The payment gateway collects and secures payment information. The payment processor verifies everything and moves actual money.

Your customers click “Pay” on your site. Gateway catches card details and encrypts them instantly. It’s a secure front door preventing sensitive information from sitting unprotected on servers. Then the payment gateway sends encrypted data to the processor. This handoff matters because the processor needs payment info to start authorization.

After that, the payment processor takes encrypted data and communicates with multiple parties. It sends authorization requests through card networks to the customer’s bank. The payment processor waits for yes or no, then sends the message back to the payment gateway.

The payment gateway receives the processor’s response and displays the results on your website.

Transaction approved? – The customer sees success.

Transaction declined? – They see an error with a message.

After initial authorization, the processor keeps working behind the scenes. It handles clearing by batching daily transactions and coordinating with card networks. The processor manages settlement by transferring money from the customer’s bank to yours.

Lots of payment solutions now combine gateway and processor functions into one platform. Stripe, Adyen, and Square offer all-in-one packages simplifying payment setup for businesses. This eliminates the hassles of managing multiple vendors and smooths everything out.

What’s the difference between a payment gateway and a payment processor?

Gateways and processors work together but handle very different jobs in transactions. Here are some basic differences between a payment gateway and a payment processor:

| Aspect | Payment Gateway | Payment Processor |

|---|---|---|

| Role in transaction | Front-end interface for customers to enter payment info; secure bridge to processor | Back-end engine that verifies, authorizes, and settles funds |

| Core function | Collects payment data, encrypts, tokenizes, and transmits to the payment processor; basic fraud screening | Authorizes transactions, moves money, handles settlement, reconciliation, and acquires bank relationships |

| Intermediary position | Sits between your business and your customer during data collection | Coordinates among the business, card networks, issuing bank, and acquiring bank |

| Service scope | Secure data transmission and minimal fraud tools | Advanced fraud detection, chargeback management, compliance monitoring, and detailed reporting |

| Integration | Typically simple via APIs, plugins, modules | More complex, often requires a merchant account with verification and underwriting |

| Dependency | Cannot complete transactions without a payment processor | Needs a payment gateway to receive customer payment data securely |

| Provider strategy | Can be chosen separately or as part of an all‑in‑one solution | Often bundled with gateways; it can simplify management and reduce costs |

Payment gateway vs. payment processor examples

Let’s look at real examples to clarify how payment gateways and payment processors actually function:

Stripe: all-in-one solution

Stripe does both gateway and processor work in one integrated platform. Someone buys on a site using Stripe. The Stripe gateway grabs and encrypts card info right on the checkout page.

Then Stripe’s processing infrastructure communicates with card networks and banks for authorization. Finally, Stripe handles settlement, moving funds to the merchant’s bank account.

Authorize.Net: gateway-focused

Authorize.Net primarily functions as a payment gateway. You use it; it captures your customer’s payment info and encrypts it on the checkout page. But Authorize.Net hands data off to the separate payment processor you choose.

Authorize.Net partners with over 20 processors, giving merchants flexibility. You might use Authorize.Net as a gateway while your acquiring bank handles processing.

PayPal: dual functionality

PayPal offers both gateway and processing in a slightly different configuration.

Customers pay through PayPal. They either enter card details directly or pay using their PayPal account balance. PayPal’s gateway collects info, and PayPal’s processing infrastructure handles authorization and settlement.

PayPal also lets merchants use PayPal as one payment method alongside others.

Square: unified commerce

Square bundles the gateway, processor, and merchant account together.

Your customer pays through Square online. Square payment gateway captures card info. Then Square’s payment processor handles authorization, communicating with card networks.

Square settles funds fast, often within one to two business days. This integration extends to Square’s point-of-sale hardware, creating seamless experiences for businesses with online and physical locations.

Adyen: enterprise platform

Adyen represents an enterprise-level all-in-one platform.

Adyen combines gateway, processor, and acquiring bank functions. The transaction happens through Adyen. Their gateway captures payment data. Adyen’s processing infrastructure routes authorization requests. And as an acquiring bank too, they handle the settlement side.

This vertical integration gives Adyen more control and lets them provide deeper insights and optimization.

Separate Setup Example

In a separate setup, you might use Authorize.Net as a payment gateway while working with First Data (now Fiserv) as a processor.

Authorize.Net gateway collects and encrypts customer payment data. It sends info to First Data, which handles authorization, clearing, and settlement.

This separation gives larger merchants the flexibility to negotiate processing rates separately from the gateway provider.

Payment gateway vs. payment processor: which do I need?

You need both.

Your online business needs both a payment gateway and a payment processor.

Online transactions require a gateway to securely collect payment information from customers on-site or app. You also need a processor to authorize transactions and transfer funds from customer accounts to your business.

But you’ve got a choice between separate providers or an all-in-one solution.

For example:

For small businesses

Small to medium businesses usually do better with all-in-one solutions. Platforms like Stripe, PayPal, and Square combine gateway and processor functions, making setup and management easier. These integrated systems eliminate the headache of coordinating between multiple vendors.

All-in-one solutions work especially well without big tech teams. User-friendly dashboards, simple integration with popular e-commerce platforms, and consolidated reporting. Deal with one company for support and account management.

For larger businesses

Bigger businesses or enterprises might want separate gateway and processor relationships. Separation provides more flexibility and customization options. Negotiate processing rates independently, choose specialized services for your industry, and switch providers more easily when needed.

If your process lots of transactions, separating the gateway and the processor might save money. You’ll have more control over payment infrastructure and optimize different pieces independently.

In-person transactions

In-person transactions work differently from online transactions.

Physical point-of-sale terminals usually have gateway functionality built into hardware. Swipe, insert, or tap the card at the terminal. It encrypts data and sends it to the processor. It needs a processor and POS hardware, but the gateway’s already built into the terminal.

Omnichannel Needs

If your business has both online and in-person sales channels, you need a solution that handles both. Unified commerce platforms like Square, Adyen, and certain Stripe setups provide consistent payment experiences across all channels.

Think about what matters most for your business. Transaction volume, international sales requirements, payment methods to support, integration complexity, team’s technical skills, and budget for payment processing fees.

Many businesses start with an all-in-one provider when small and switch to separate providers as they grow and needs get more complex.

How to choose a payment processor and payment gateway?

Picking the right processor and gateway takes careful thinking about several factors. Let’s look at some deciding factors:

Transaction fees

Start with transaction fees. Most processors charge a percentage of each transaction plus a fixed fee. Standard online rates usually fall between 2.6% and 3.5% plus $0.10 to $0.30 per transaction.

Compare pricing across providers and check if volume discounts are available as your business grows.

Check supported payment methods

Payment methods matter. Beyond credit and debit cards, customers increasingly want digital wallets (Apple Pay, Google Pay, PayPal), buy now pay later services, and bank transfers.

Pick a provider supporting payment methods your customers actually use.

Review international capabilities

Multi-currency and international support are crucial for selling globally. Check whether your provider supports the currencies you need and offers good foreign exchange rates.

International transaction fees add up fast. You should understand the full cost picture for cross-border sales.

Check integration support

Integration ease affects how quickly you start taking payments. Look for providers with plugins or modules for your e-commerce platform (WordPress, WooCommerce, Shopify, or something custom).

Verify security features

Don’t compromise your security.

Make sure any provider you consider is PCI DSS compliant. Look for extra security measures like tokenization, encryption, 3D Secure authentication, and fraud detection tools.

Understand Settlement Timeframes

Settlement timing affects cash flow.

Most processors settle funds within one to three business days. Some offer next-day or same-day settlement for an extra fee. Faster settlement helps you with quick revenue access.

Customer support access

On online payments, everything breaks all the time. If you don’t have customer support access, you’re going to suffer miserably.

Check support channels available (phone, email, chat), hours open, and languages supported. Read reviews about response times and problem-solving effectiveness before choosing one.

Consider recurring payment

Recurring payment features are essential for subscription businesses. Make sure your chosen provider handles subscription billing, automatic renewals, and flexible billing intervals.

Look for features like dunning management and recovering failed subscription payments.

Evaluate chargeback handling

Chargeback handling varies across providers. Understand the chargeback fees each provider charges and the tools offered to prevent or dispute chargebacks.

Some providers give better chargeback protection than others. Always pick the better one.

Review reporting tools

Reporting and analytics help understand the business. Good providers offer detailed transaction reports, customer insights, and revenue analytics. These tools help make smarter business decisions.

Plan for scalability

Make sure the payment solution grows with you.

Can your provider handle increasing transaction volumes? Do they offer features needed to expand internationally or add new sales channels?

Make sure you tick as many boxes as possible before picking one.

Read contract terms carefully

Contract terms need a close look.

Check setup fees, monthly minimums, cancellation fees, and contract length requirements. Some providers work month-to-month, while others want annual commitments.

Test the experience

Try the checkout experience yourself before committing.

Sign up for trial accounts when possible, and process test transactions. Get a test card number for testing and run demo transactions. Customer experience during checkout directly impacts conversion rates.

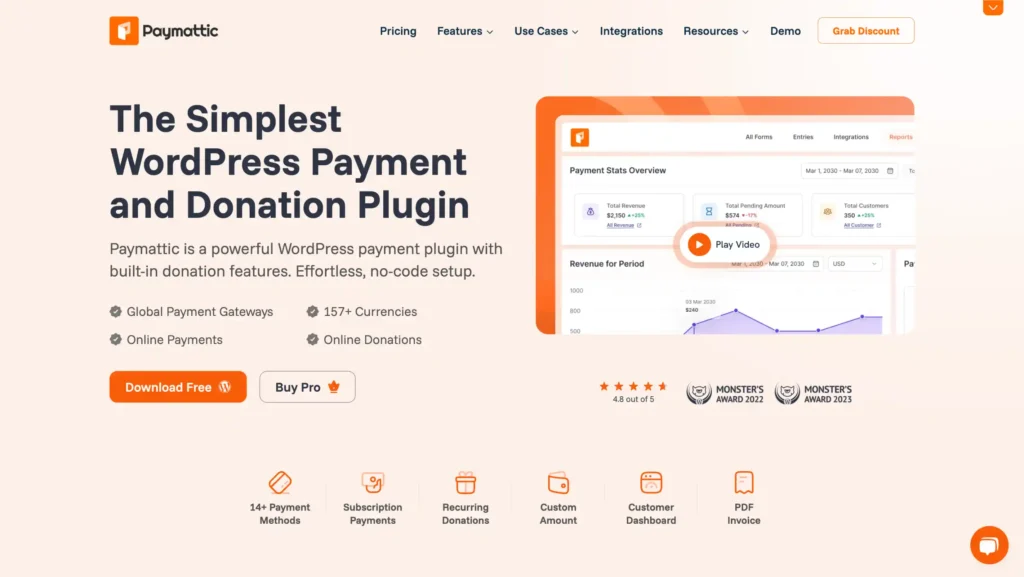

Paymattic – a WordPress payment and donation plugin

Paymattic is a simple and powerful WordPress payment & donation plugin for your online payments, donations, and subscriptions in one place.

With support for Stripe, PayPal, offline payments, subscriptions, multi-currency, and detailed reporting, it’s your all-in-one solution for collecting payments, managing donations, and growing your business with ease.

- 13+ global payment gateways covering the whole world.

- Supports 157+ currencies.

- Supports both one-time and recurring payments.

- Offers a detailed customer dashboard to manage subscriptions.

- Offers a detailed report dashboard.

- Integrates with 15 major tools.

- Offers a smooth payment/donation form builder with 35+ custom input fields.

- PCI-DSS compliant and built with security best practices.

- Advanced fraud protection with Honeypot, ReCAPTCHA V2 and V3, and Cloudflare Turnstile.

- Offers webhooks, filters, and a REST API for custom development.

Wrapping up

In short, both a payment gateway and a payment processor are essential, and they do different jobs.

The gateway securely collects and transmits customer payment data, while the processor authorizes transactions, moves funds, and handles settlements, fraud, and chargebacks.

If you are still wondering about payment gateway vs. payment processor, this article should clear the confusion.

And for most small businesses, an all‑in‑one provider like Stripe, PayPal, or Square keeps things simple. Larger teams may benefit from separating the gateway and processor for more control and better rates. Choose based on your payment methods, security needs, international support, fees, settlement times, and how well it integrates with your stack.

Join the thousands already enjoying Paymattic Pro!

Mahfuzur Rahman Nafi

Mahfuzur Rahman Nafi is a Marketing Strategist at WPManageNinja. With 4 years of experience in Product Marketing, he has developed marketing strategies, launched products, written content, and published websites for WordPress products. In his free time, he loves to read geeky stuffs.

Leave a Reply