9 Min Read

How to Set Up Multiple Stripe Accounts? Unlock the Benefits

Table of Content

Download Paymattic – it’s Free!

Subscribe To Get

WordPress Guides, Tips, and Tutorials

We will never spam you. We will only send you product updates and tips.

As a business owner, you know Stripe is the best when it comes to easy payment processing. It’s one of the best payment gateways capitalized by millions of companies.

With Stripe, you’re not only accepting payments globally but also increasing your chances of maximizing conversions. As a single-store owner, you may be satisfied with a single Stripe account.

But what if you have more than one business or have to manage multiple e-commerce stores? Would you still like to stick to a single Stripe account, or would you prefer to create more?

Business owners like you often need clarification on whether they can create multiple Stripe accounts from a single email address. Or can you use one Stripe account for multiple businesses?

So, in this article, clearing up these confusion, we’ll show you how to set up multiple Stripe accounts, manage them from a single dashboard, and explore some benefits and drawbacks as well.

What does multiple Stripe accounts mean?

Stripe offers some cool features to its users to make transactions smoother than ever. Along with the feature, it has a multi-account attribute that allows you to create multiple Stripe payout accounts with the same email address from a single Stripe dashboard.

With this handy feature, you have the option to either establish a single account and provide access to several team members or create Stripe sub accounts and connect them with your primary Stripe account.

You’ll be able to switch between the accounts whenever it’s necessary.

Why do you need more than one Stripe account?

You should utilize a separate Stripe account for each project, business, or website that functions independently. For companies that operate in different locations or currencies, managing Stripe multiple payout accounts is a must-do job.

If you’re still confused about why you need to set up multiple Stripe accounts under the same company, here are the reasons:

Separate tax and legal-related information

To adhere to Stripe’s guidelines, it’s necessary to maintain separate tax and legal entity information for each account. Each account can only be linked to the tax ID and legal entity of a single business.

If you have multiple businesses with distinct tax ID information or separate legal entities, you must create Stripe sub accounts for each of them.

Maintaining the legal and tax issues for various businesses can be confusing and too complex.

However, with multiple Stripe payout accounts, you can efficiently manage taxes for different businesses while using a unique tax ID for all of your other projects.

When you operate multiple projects or businesses under the same legal entity, you’re allowed to use the same tax ID and business information across many Stripe accounts.

It allows proper segmentation of financial information while simplifying tax processing by consolidating tax reporting under one tax ID.

Unique statement descriptor

Using one Stripe account for multiple businesses can create confusion for your customers.

For example, if a customer makes a purchase from your business “ABC” but sees a charge on their statement from “XYZ,” they might not recognize it, which leads to confusion or even a dispute.

Managing business statements also becomes more difficult. Transactions from different businesses can overlap, making it easy to miss important data or misattribute sales.

To avoid these issues, it’s essential to use unique statement descriptors for each business.

That’s why it’s best to use multiple Stripe accounts for separate businesses. It promotes transparency, simplifies record-keeping, and helps prevent unnecessary disputes.

Subscribe Newsletter

Subscribe to our newsletter for updates, exclusive offers, and news you won’t miss!

Proper reporting

Having multiple Stripe accounts makes accurate reporting much easier, as data from each business is processed and analyzed separately.

This separation allows you, as a business owner, to clearly evaluate the performance of each venture. By reviewing individual reports, you can identify strengths, spot weaknesses, and implement targeted strategies to improve operations for each business.

Separate banks payout

For each additional Stripe account associated with a project or business, you can connect to a separate bank account for payouts.

This allows you to keep the funds from different projects or businesses segregated, making it easier to track and manage transactions individually.

However, if you prefer a more streamlined approach, you can also use the same bank account for payouts across multiple Stripe accounts.

This may simplify your accounting and reconciliation processes, especially if you’re managing combined finances for multiple projects or businesses.

How to set up multiple Stripe accounts?

Setting up a multi-Stripe account is very simple. With just a few clicks, you can create multiple accounts on Stripe from a single dashboard.

- Log into your Stripe account

- In the upper-left corner, you’ll see your Stripe account. Click on it

- Click on the + New Account

- Give an account name

- You’ll find an activate option

- In this section, provide your account information and bank details

You’re done with your new Stripe account.

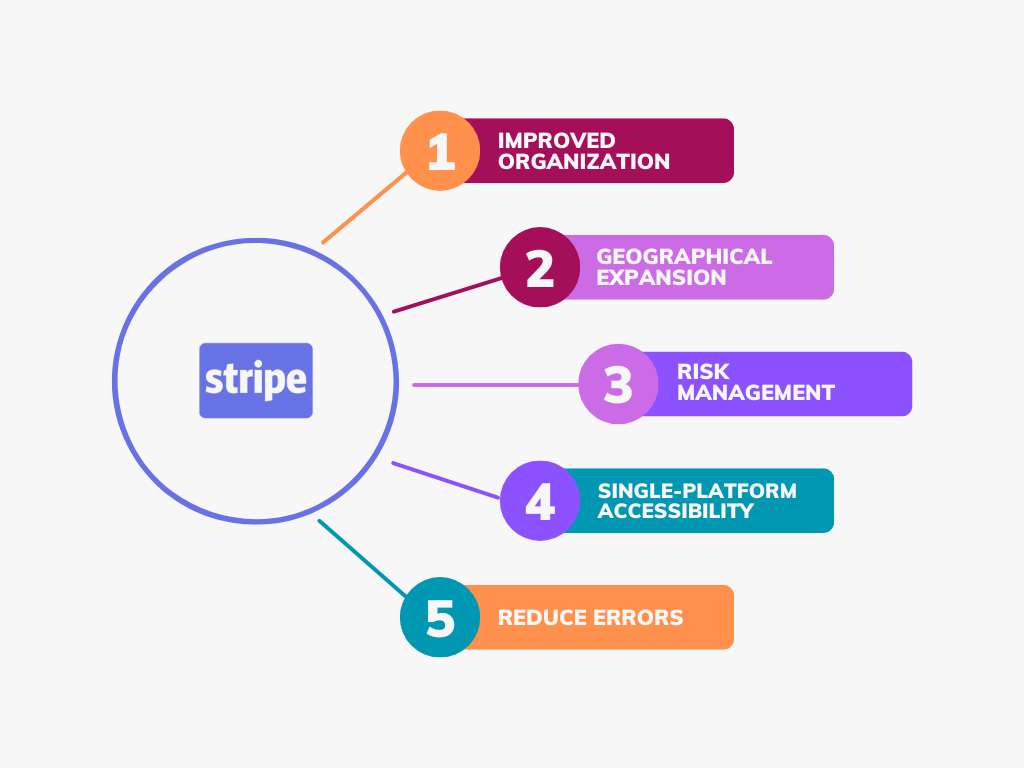

Advantages of multiple Stripe accounts

When you use multiple Stripe payout accounts for separate businesses, you’re more likely to enjoy a wide range of benefits. The key advantages are:

Improved organization

Having multiple Stripe accounts can help keep finances and transactions organized, particularly if your business operates in multiple ventures or projects. As a result, it becomes easier to track and manage transactions for each specific business unit.

Geographical expansion

If you’re operating your business in different regions, having a separate Stripe account for each country can simplify compliance with local regulations and tax requirements.

It also enables you to localize payment methods and currencies, improving the user experience for your customers in diverse geographical areas.

Risk management

If your business model involves higher-risk transactions or industries, having more than one Stripe account can help you mitigate the effects of any potential problem.

An issue with one account won’t always have an impact on the others.

Single-platform accessibility

You can access different information about different accounts on one dashboard. This saves valuable time and reduces the hassle of switching accounts repeatedly.

Reduce errors

As you can keep track of multiple account payments in a single dashboard, you’re more likely to minimize costly mistakes. It significantly decreases the chances of errors.

Disadvantages of having Stripe multiple accounts

Every coin has two sides. Along with having numerous benefits of multiple Stripe payout accounts, it has some drawbacks as well.

- There may be associated fees for each Stripe account. So you might put in some extra money into maintaining more than one account.

- If any customer mistakenly uses the incorrect Stripe account for a certain transaction, it may create confusion and possibly affect customer support.

- Sometimes managing multiple Stripe accounts can be challenging and time-consuming.

- Data duplication is a common issue among several accounts.

- If any fraudulent or suspicious activity is associated with one account, it is highly possible that it could negatively impact the other connected accounts as well.

How to monitor Stripe multiple payout accounts?

There are two ways to monitor Stripe multiple accounts from a single dashboard.

View one at a time

With this method, you can monitor your Stripe accounts one at a time. Go to your Stripe dashboard; in the upper-left corner, you’ll find all the accounts displayed there.

Select the account you want to monitor and go through it.

The issue with this process is that you can only go through one account detail at once. This might be time-consuming, so there is another way out too.

Combined view of all accounts

Using third-party tools like Putler and ChargeStripe, you are able to monitor all your Stripe accounts simultaneously. These tools enable you to access both aggregated and separate reports for all of your Stripe accounts from one place.

It helps to monitor the accounts and review the reports faster.

Can I use one Stripe account for multiple websites?

Yes, you can use one Stripe account for multiple websites or businesses. If you’ve got a WordPress website, you can easily integrate your Stripe account using Paymattc for free.

It’s a WordPress plugin specially designed to accept one-time and subscription payments globally.

- Install and activate Paymattic → Payment Gateway from your WordPress dashboard.

- From the left navigation bar, click on Stripe.

There are two modes available, “Test Mode and Live Mode.” Choose Test Mode for testing purposes and Live Mode for accepting live Stripe payments.

- Provide your Public key and Secrect key and connect to your Stripe account to enjoy a seamless transaction experience.

Do the same process if you want to use one Stripe account for multiple websites. Go for the Paymattic Agency plan, it allows up to 20 domains . It’s a perfect fit for business owners who runs multiple online stores.

Wrapping up

It’s crucial to have multiple Stripe accounts if you operate various businesses and projects that too in different locations.

It can bring transparency to your customer statement. Its accurate reporting allows you to make data-driven decisions and implement target strategies.

By unlocking the potential of Stripe multiple accounts, you can streamline your transactions, minimize errors, and improve the overall customer experience.

Taking this thoughtful approach, carefully consider your business needs and scale the advantages and disadvantages to make the best decision.

Frequently Asked Questions

Here are answers to some frequently asked questions about creating multiple Stripe accounts for online stores.

Q. Can I create multiple Stripe accounts with the same email address?

Yes, Stripe allows you to create and manage multiple accounts under the same email address. You can do this directly from your Stripe dashboard by selecting “Create a new account.”

Q. Can I use the same Stripe account for different stores?

Yes, you can use one Stripe account for multiple businesses/websites if they all fall under the same legal entity and share the same tax ID and business information.

Q. Can I merge two Stripe accounts later?

No, you can’t merge two accounts into one. Stripe doesn’t allow this.

Q. Do I need a separate bank account for each Stripe account?

No, it’s not required. You can use the same bank account across multiple Stripe accounts if you wish.

Q. Can I switch between multiple Stripe accounts easily?

Yes, you can switch between accounts right from your Stripe dashboard. Click on your profile icon and select the desired account.

Q. Will creating multiple Stripe accounts affect my credit or business profile?

No, creating additional Stripe accounts does not affect your personal credit. Each account is evaluated independently and tied to your business or project.

Q. Does Stripe charge extra for having multiple Stripe payout accounts?

No, Stripe does not charge any fees for creating or maintaining multiple accounts. You only pay standard transaction fees when you process payments on each account.

Join the thousands already enjoying Paymattic Pro!

Leave a Reply