SEPA Payment Unveiled: A Complete Guide to European Transactions

Table of Content

Download Paymattic – it’s Free!

Subscribe To Get

WordPress Guides, Tips, and Tutorials

We will never spam you. We will only send you product updates and tips.

If you want to make cashless payments in Euro anywhere in the European Union, the SEPA payment method is the easiest, fastest, and safest method to do this.

If you operate a business in Europe or serve EU-based customers, you should familiarize yourself with this widely utilized payment network.

SEPA transfer provides you with domestic banking experience in international transactions.

So, this article will give you a complete tour of SEPA payments, how they work, the available countries, and how businesses can use it to move money.

What is the SEPA payment method?

SEPA stands for Single Euro Payments Area, which is a transaction system for the European Union to transfer money effortlessly and receive it across one eurozone country to another.

SEPA payment was initiated by the EU to simplify cashless payments and standardize euro-denominated bank transfers within European countries.

SEPA transfer enables individuals, businesses, and institutions to make transactions in euros across participating countries under the same basic set of rules and standards.

The goal is to make cross-border payments within this region as easy, efficient, and cost-effective as domestic payments.

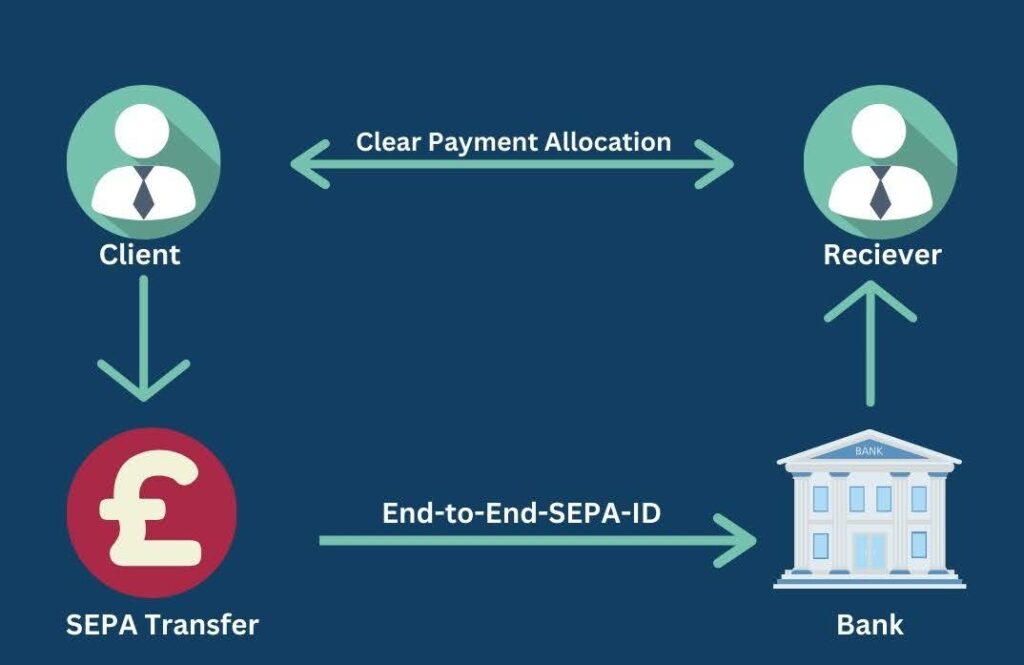

How does a SEPA bank transfer work?

SEPA bank transfers made international transactions simple and less expensive. Its standardized system allows you to debit directly to any EURO-denominated bank account in the SEPA region.

If you’re a SEPA account holder, you can accept direct deposit payments and also issue payments from your bank account electronically, even while traveling to other countries.

Each bank account in the SEPA area has a unique IBAN (International Bank Account Number), which is the equivalent in Europe of a US bank account number.

Just as domestic transfers in the United States require the bank account and routing numbers of both the sender and recipient to successfully conduct a funds transfer, to make a SEPA bank transfer, the IBAN identification code is required.

In SEPA bank transfers, four payment schemes simplify both cross-border and domestic transactions.

The four SEPA payment processing schemes include:

- SEPA Credit Transfer

- SEPA Instant Credit Transfer

- SEPA Direct Credit Core

- SEPA Direct Debit Business-to-Business

These are used by around 4,000 Payment Service Providers in Europe.

Including 25 billion credit transfers and 21 billion direct debits, a total of over 46 billion Euro transactions happen in SEPA each year.

Let’s break down each transfer process in depth.

SEPA Credit Transfer (SCT)

SEPA Credit Transfer is used for one-time fund transfers or recurring payments between two banks through IBN codes. When a consumer purchases something in SEPA regions with EUR, this type of transfer system is used.

Businesses that are not located in SEPA countries aren’t able to use SEPA Credit Transfer.

Let’s imagine that you want to transfer €200 from your Italian bank account to your friend’s account in Portugal. Since both countries are members of SEPA, this would work like a domestic transaction between these two countries using SEPA Credit Transfer.

Transfer limit: With SCT, the maximum SEPA transfer limit is €999,999,999.99, one cent less than a billion euros.

SEPA Instant Credit Transfer (SCT Inst)

Most international transfers require a transfer request to be submitted first, which can take hours to days for it to be settled. SEPA Instant Credit Transfer has made this easier than ever.

It’s available 24/7 and facilitates real-time transactions. A SEPA account holder can make EUR-based transactions in the eurozone at any time, any day, and they’ll be processed immediately.

It’s all about the speed. Once the sender confirms SEPA payments using Instant Credit Transfer, it takes less than 10 seconds for the recipient to receive the funds.

This type of payment scheme is often used between buyer and seller, especially for e-commerce payments.

However, to use this service, both the sender’s and receiver’s banks must be registered as SEPA instant members.

Transfer limit: You can transfer a maximum of €100,000 per transaction with SEPA Instant Credit Transfer.

Find out the 9 Best WooCommerce Payment Gateways for WordPress

SEPA Direct Debit (SDD)

SEPA Direct Debit is based on bank-to-bank transfers. Like other SEPA payment schemes, you can’t use a credit card in this process. Non-EU businesses commonly interact with this option.

SEPA Direct Debit is frequently used for automated or recurring payments. Like internet or electric bills, monthly rent, and regular loan repayment installments.

It’s a pull-based system. The receiver must send a transfer request to the sender to withdraw money from his account. Before any transfer, the sender needs to sign an “approval”, which will allow the receiver to withdraw the signed amount of money at regular intervals.

Since transactions can only be conducted in Euros, if any of the corresponding banks involved in the process are not using the same currency, there can be an additional charge for currency exchange.

Transfer limit: As the transaction depends on the sender and receiver’s agreement, there is no transfer limit.

Subscribe Newsletter

Subscribe to our newsletter for updates, exclusive offers, and news you won’t miss!

SEPA Direct Debit Business-to-Business (SDD B2B)

The functionalities of SEPA Direct Debit Business-to-Business are similar to the SEPA Direct Debit. The only difference is that Direct Debit B2B only operates commercial transactions between businesses.

This scheme offers distinct advantages tailored to the unique needs of B2B payments. Besides, SDD B2B provides enhanced flexibility, control, and security for businesses conducting financial transactions with other companies as well.

One of the key points of this scheme is that it facilitates fast and secure cross-border transactions with dispute-resolution mechanisms. This offers a more transparent and trustworthy environment for B2B transactions.

Transfer limit: Similar to SDD, SDD B2B has no transfer limit.

List of SEPA countries

Although SEPA is for Euro payments inside European countries, there are also non-Euro countries that are part of it. Currently, a total of 36 countries are members of SEPA, including 9 non-EU countries as well.

For instance, the United Kingdom (UK), which underwent Brexit in 2020, and other European nations like Iceland, Norway, Monaco, and Switzerland, remain active members of SEPA despite not being part of the European Union (EU).

Here is the list of SEPA countries:

EU-member SEPA countries

1. Austria 2. Belgium 3. Cyprus 4. Estonia 5. Finland 6. France 7. Germany 8. Greece 9. Ireland 10. Italy 11. Latvia 12. Lithuania 13. Luxembourg 14. Malta 15. Netherlands 16. Portugal 17. Slovakia 18. Slovenia 19. Spain 20. Bulgaria 21. Croatia 22. Czech Republic 23. Denmark 24. Hungary 25. Poland 26. Romania and 27. Sweden

Non-EU SEPA countries

28. Andorra 29. Iceland 30. Liechtenstein 31. Monaco 32. Norway 33. San Marino 34. Switzerland 35. United Kingdom (UK) 36. The Vatican City State

SEPA payment processing time

The processing time for the SEPA payment method depends on the type of SEPA transfer you use.

Different payment options require different durations for transactions.

SEPA Credit Transfer: Usually, it takes 24 hours, or the equivalent of one business day, to complete a transaction.

SEPA Instant Credit Transfer: Transferring funds using Instant Credit Transfer only takes 5 to 10 seconds to complete.

SEPA Direct Debit: Typically takes 3-5 days. In some cases, it can take up to 14 days.

SEPA Direct Debit Business-to-Business: Similar to Direct Debit, B2B transactions may take a minimum of 3 business days to up to 14 days.

Wrapping up

SEPA payment method revolutionized transactions within the Eurozone. It streamlined cross-border payment for both individuals and businesses in a cost-effective way.

SEPA payments are quite common in European countries. It’s also becoming popular in non-EU countries like the United Kingdom and others for safe and secure transactions.

It simplifies international funds transfers while bridging borders and fostering economic integration. By embracing SEPA, you’re not just making transactions; you’re connecting with a broader vision of a unified, prosperous Europe.

Join the thousands already enjoying Paymattic Pro!

Leave a Reply