9 Min Read

How Can I Accept Donations Without Being a Nonprofit?

Table of Content

Download Paymattic – it’s Free!

Subscribe To Get

WordPress Guides, Tips, and Tutorials

We will never spam you. We will only send you product updates and tips.

TL;DR:

You don’t need 501(c)(3) nonprofit status to legally accept donations for a meaningful cause! Whether you’re an individual, a for-profit business, a startup, or an unregistered nonprofit, you can still raise funds if you follow the right methods. Sure, donors can’t write off taxes, but a compelling cause still motivates people to give, especially when 77% prefer supporting socially responsible businesses anyway.

This guide breaks down the top 5 strategies to help you fundraise ethically.

Nonprofit organizations that are registered under 501c3 can easily raise donations with their effective fundraising campaigns. But what if a nonprofit without 501c3 registration wants to fundraise? Is it possible?

Questions also may arise: Can I accept donations without being a nonprofit? In simple words, the answer is yes, you can.

Typically, organizations without 501c3 status are unable to apply for grants, but there are several ways to legally receive donations to secure funding for their operations and fulfill their community-oriented mission.

Maybe the donors can’t write off their tax contributions, but an impactful and compelling cause can still draw in support.

So, in this article, we’ll talk about the 5 best ways to legally accept donations as an individual or without being a nonprofit, which is also applicable to a nonprofit without 501c3 status.

What does 501(c)(3) status mean?

First of all, if you’re running a for-profit business, you can skip this section and go straight to the best ways of legally accepting donations.

501(c)(3) is a specific section of the U.S. Internal Revenue Code (IRC) that designates a nonprofit organization as tax-exempt. Organizations that meet the 501(c)(3) status can claim to their contributors that donations to them are tax-deductible.

A for-profit business never gets registered under 501(c)(3) status, as they have to pay tax.

To be eligible for 501(c)(3) status, an organization must be organized and operated exclusively for charitable, educational, religious, scientific, literary, or other specific purposes, as defined by the IRS.

Additionally, by donating to 501(c)(3) organizations, donors can often claim tax deductions for their contributions, which motivates charitable giving.

For-profit businesses, check out this: Can a For-Profit Business Accept Donations?

5 Best ways to accept donations without being a nonprofit

- Crowdfunding

- Donate button

- Fiscal sponsorship

- Donation drive

- Affiliates with local

Let’s break down each of these sections in depth.

Crowdfunding

Crowdfunding is a universal way of raising funds. Anyone can arrange or participate in a crowdfunding campaign. You can receive funds without 501(c)(3) status and accept donations without being a nonprofit as well.

Whether you’re a nonprofit or for-profit, crowdfunding is always a great solution to collect donations from mass people. Crowdfunding means collecting small donations from a large number of donors.

Usually, it’s associated with raising funds for charitable causes, creative projects, or early-stage start-ups. However, crowdfunding is not designed for for-profit businesses as a primary means of financing. It could be used as an additional method of fundraising.

As an early-stage start-up, you should seek ways to cut costs and increase profits. Here, you can consider crowdfunding as an option to legally accept donations as an individual and allocate extra funds to your business.

It’s obvious that people won’t give you money without something in return. So make sure you’re giving them some reason to contribute to you.

You may offer a one-time free service to the donor, offer a non-monetary product or experience, and make a promise to share a percentage of the profit in charity.

These small gestures and details motivate supporters to contribute to the launch of your business.

To do online crowdfunding, all you need to do is choose a platform, create a donation page, choose a catchy title, and go!

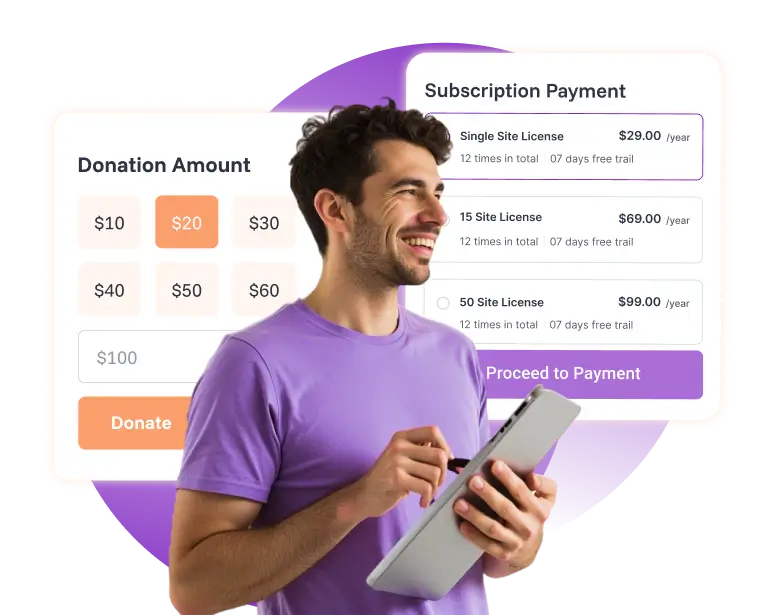

You can easily receive crowdfunding using the Paymattic donation plugin, which offers tons of features along with 14 payment gateways worldwide.

“Pro Tip – Want to reduce the workload? Paymattic offers excellent-looking ready-to-use donation forms for you.”

To do it in a brick-and-mortar store, place a donation box at the checkout point and make it noticeable to everyone.

Donate button

To accept donations without being a nonprofit, you can utilize the PayPal donation button. PayPal for nonprofits offers a donate button to accept donations directly on your website.

You can place the donation button anywhere on your website. Whenever your customers visit your website to buy something, they can contribute some extra with the donate button if they wish to.

Ensure you provide a proper explanation of why you want to raise donations.

PayPal wants to make the WordPress donation process easier, so there is no form or customization available. This is the safest and best way to accept donations without being a nonprofit.

Fiscal sponsorship

Fiscal sponsorship for nonprofits is a great fundraising idea if you want to legally accept donations as an individual. It’s basically when an existing 501(c)(3) lets you use their nonprofit status while you get your act together.

So, how do fiscal sponsorship organizations actually work?

Imagine you’ve got a real cause and want to accept donations without 501c3 status. A nonprofit organization registered as 501(c)(3) steps in and says, “We’ll handle the donations for you.” Donors donate to them, but the money goes toward your project. And yes, those donors still get their tax deductions.

In short, “Fiscal sponsorship organizations are tax-exempt groups that receive funds on behalf of a nonprofit or project that doesn’t have a tax-exempt status yet.”

The two most common models of Fiscal sponsorship are: 1. Comprehensive sponsorship, and 2. Pre-approved grants. Both are good choices for legally accepting donations as an individual or for a nonprofit without 501c3 status.

Comprehensive Sponsorship, where the sponsor takes full control. They collect the money, they decide how it gets spent, and they handle everything. You’re more like a program under their umbrella. This works if you’re just dipping your toes in and want someone experienced calling the shots.

Pre-Approved Grants give you breathing room. They still legally hold the funds, but once they okay your plan, you can execute it your way. Way less micromanaging. This one’s better if you’ve already applied for 501(c)(3) status or you’re running with a small team and know what you’re doing.

So, which one should you pick?

If you’re a complete beginner, go comprehensive. You’ll learn a lot from people who’ve been there.

If you’ve got experience but just need that tax-exempt stamp? Pre-approved grants let you stay independent.

Think of fiscal sponsorship for nonprofits as your temporary fix while building something bigger. It’s not a permanent solution, but it gets you moving now instead of waiting around for paperwork to clear.

Subscribe Newsletter

Subscribe to our newsletter for updates, exclusive offers, and news you won’t miss!

Donation Drive

A donation drive is a collective effort to gather essential items, financial contributions, or assistance to benefit a specific cause or community in need.

Consider a physical donation drive if you feel uncomfortable asking for monetary donations because of your nonprofit status. There are a lot of people around us suffering from less clothing, shoes, food, or other things.

A donation drive can be a great alternative to raising monetary donations. You can ask your consumers to donate their unused clothes or shoes that they no longer wear.

“No one has ever become poor from giving.”

– Anne Frank

If you want to help an organization that works in animal welfare, like crowdfunding, consider placing a donation box on behalf of the organization. And obviously, give the proper reason for donating.

This is an excellent way of accepting grants for nonprofits without 501(c)(3) registration.

For example, donate to building shelters for domestic animals, buying dog leashes, buying cat food, etc.

People from around the world are often suffering from natural disasters and conflicts. As a for-profit business, you can gather some young blood and run a drive to help the affected ones.

Whether it’s a clothing drive for those experiencing homelessness, a food drive to combat hunger or a fundraising drive for a charitable organization, donation drives serve as powerful vehicles of compassion and generosity.

Affiliates with local

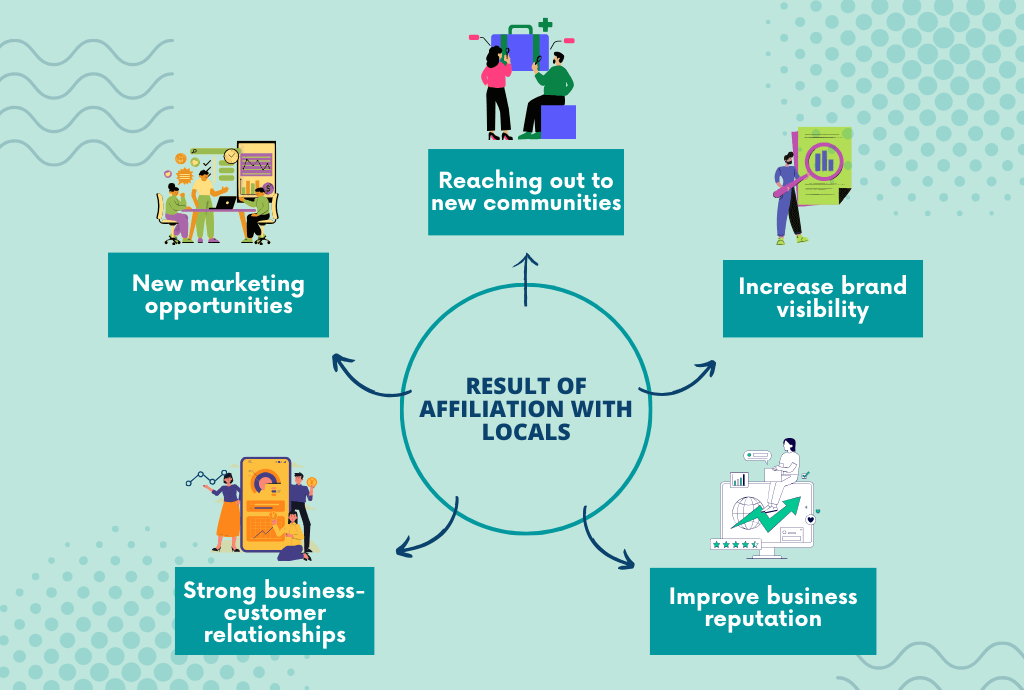

Affiliation with locals is a powerful strategy for you to accept donations without being a nonprofit, and also for nonprofits without a 501(c)(3) registration. When you affiliate with another business, organization, or any influencer, you tap into their community.

By gaining their trust and engagement, you’re more likely to raise easy donations because you get recommended by someone they know or a business they trust.

Local affiliation often comes with shared values. By partnering with a local charitable organization, you demonstrate that you care for society despite not being a nonprofit.

It’ll differentiate you from others and people definitely appreciate your participation in the greater good. As a result, the relationship between you and your consumers becomes stronger. It’ll take you to gain some repeat contributors and help you to gain sustainability.

It’s considered one of the best donor retention strategies as well.

“In fact, 77% of individuals prefer buying from companies with social responsibilities.”

Source – HAVARD Business School report

Partnering with local organizations also opens new windows of marketing opportunities.

Wrapping up

To perform a fundraising campaign for a charitable cause, you don’t always need to be registered as a 501(c)(3). Even if you can accept donations without being a nonprofit, all you need is a valid reason.

There are additional ways to legally accept donations as an individual, aside from the tax exemption.

But remember, you’re following the rules of fundraising as per the IRS and complying with all tax requirements.

Join the thousands already enjoying Paymattic Pro!

Leave a Reply