7 Min Read

Can An LLC Accept Donations?

Table of Content

Download Paymattic – it’s Free!

Subscribe To Get

WordPress Guides, Tips, and Tutorials

We will never spam you. We will only send you product updates and tips.

Every email you send and every contact you make are for the expansion of your business. But money is the driving factor for any company. And accepting donations can do wonders for your venture.

Donations are always linked to non-profit organizations. Naturally, you might wonder, can an LLC accept donations?

In this blog, I’m going to tell you why you should take donations as an LLC. At the end, I’ll share some free tips on how you can make a donation page on your website.

So, why wait? Let’s get started.

What is an LLC license?

LLC stands for Limited Liability Company. LLCs are formed keeping “asset protection” in mind. LLC works as a separate legal entity from its owners. It works as a protective wall between you and your personal assets.

When a lawsuit is filed against your LLC business, the LLC is responsible for its own lawsuits and debts. As a result, the owner’s personal assets are not harmed.

Also, the LLC’s profits are not taxed. When other business models get taxed twice—once for the business profit and once for the owner’s income. LLCs’ profits are not taxed. Owners only pay tax once on the revenue.

An LLC is also easy to form. And flexible to operate.

So, how do you form an LLC?

- You pick a name

- Prepare your LLC formation documents

- Submit your LLC operating agreement

- Pay the filing fee and grab your LLC license

Can an LLC accept donations?

Yes, your LLC can accept donations as long as it complies with local laws.

Whether your business is already running or you want to launch a new start-up, you can accept donations from donors. Most of the time, accepting donations is tied to non-profit organizations. But your small business or for-profit business can also get funds through donations.

There are many reasons why you should accept donations as a business. We’ll talk about this in the later section of this blog.

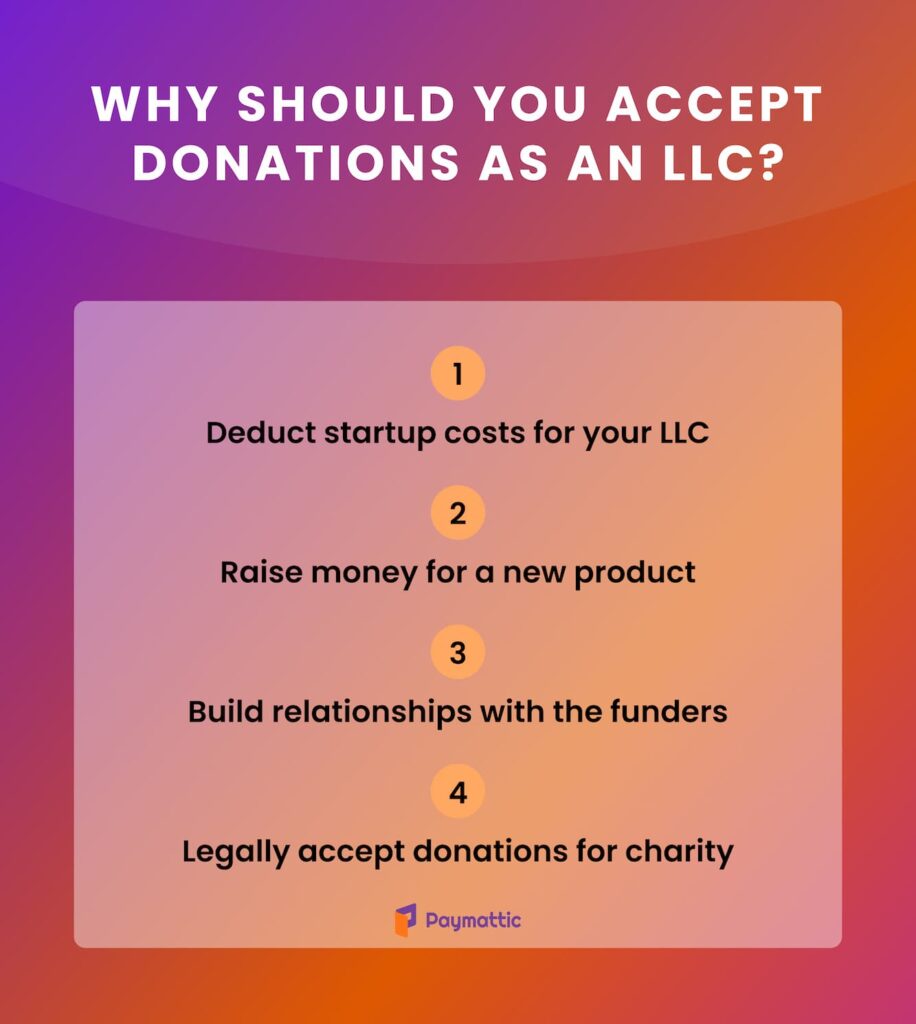

Why should you accept donations as an LLC?

The main goal for any business is growth. Every email you send and every marketing strategy you apply are for the growth of your business. You should accept donations even without being a nonprofit.

Let’s discuss why your LLC should legally accept donations:

1. Deduct startup costs for your LLC

Whether you are a sole proprietor or in a joint venture, launching a new product eats up a lot of money. And the marketing and distribution take a huge toll on your business fund. For that, reducing the startup cost and maximizing profits are huge deals.

Legally accepting donations can reduce your initial business costs. Accepting funds can help deduct the primary expenses and get your business started. Not only that, but crowdfunding can also lower the production cost of any product. So that you get maximum profits.

2. Raise money for a new product

Raising funds for a business is the most crucial challenge for any business. When it’s a new product you want to launch, the barrier is even stronger. What you can do is take donations from people who believe in the product. Take a donation from them, offering early access to the product.

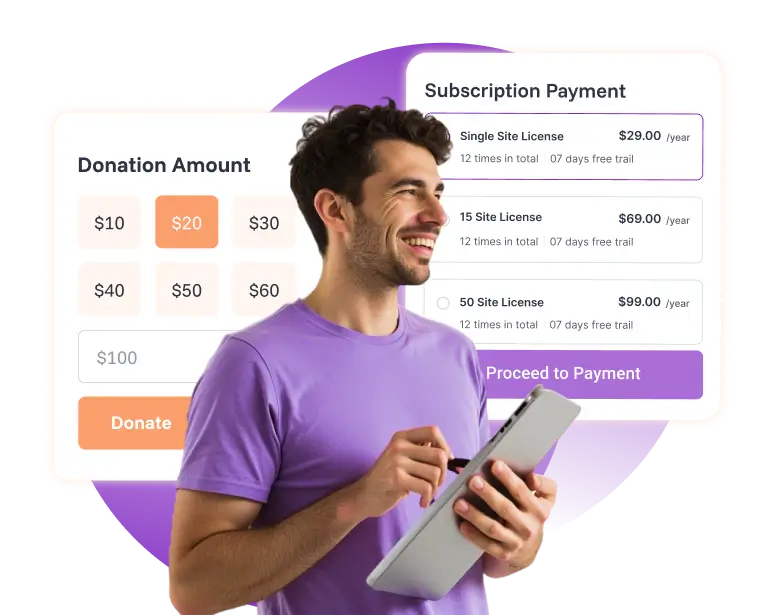

Back in the day, raising money for a new product was a tough nut to crack. Now many websites and plugins, like Paymattic, simplify the process of accepting money to launch a product. Just set up a website and install the plugin. And your donors can donate directly on the website.

3. Build relationships with the patrons

The people who contribute to your business are the funders. Funders can boost your business when you are fundraising without being a charity. These are the people or institutions that can make your business grow faster.

But how?

Crowdfunding can help you with this. As funders write off donations for your LLC, they care about your business. In case you need other support, you can just reach out to them. Because business, at its core, is more about relationships.

4. Legally accept donations for charity

Donating and giving back to charities helps you make an impact on society. Also, 94% of consumers think businesses should give back to the community. Giving back as a business greatly benefits your business.

Let me show you how:

- Cut down taxes

Accepting donations to give away can reduce the tax you have to pay. Usually, for-profits get tax reductions when they sponsor charities. Your business should accept donations to give back to the community.

Just make sure you are complying with your local laws.

- Improve your business’s perception

Corporate philanthropy is a real deal when it comes to public perception. Donating to charities shows that your business cares for society. Users appreciate this gesture and tend to buy from you more often.

This is how you build a loyal customer base that also values your philanthropy.

- Create new opportunities

When you get philanthropic funding and spend it on donations, you make an impact on people’s sentiments. You make newspaper headlines. Also, you can highlight the good work on social media. This is how you get attention and exposure.

Other companies tend to reach out to you. And you get better deals from partnerships for your for-profit business.

- Build community

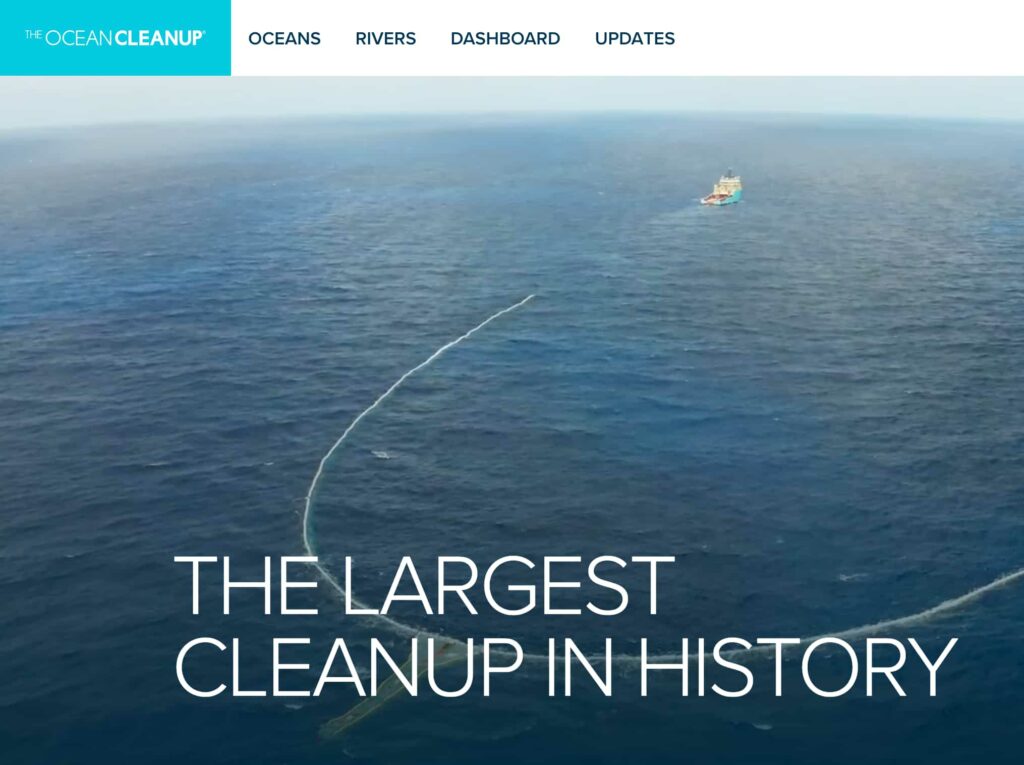

Let me give you an example of the famous YouTuber, Mr. Beast. He recently started a campaign named “The Ocean Cleanup.” The goal is to clean the oceans by collaborating with other influencers.

He built a community that believes that cleaning the sea is a very important charity. They get funding from people and clean the seas. That’s how he’s built an organization of people who act as a single unit.

Is Mr. Beast a charity? – No.

But does this charity works help his business? – Of course.

Communities will take care of your business.

Subscribe Newsletter

Subscribe to our newsletter for updates, exclusive offers, and news you won’t miss!

Can I accept donations without being a nonprofit?

Yes. Right now, there are no laws that restrict for-profit businesses from accepting donations. Also, it’s not illegal to take money for your business without giving people something in return.

Think of it this way. You might ask for donations from your relatives and friends when you start a new business. Also, there are private and public corporations that provide business grants. Most of the time, these are taxable grants. Which is another form of donation.

Not only that, but there’s also a very popular form of donation medium. This is called crowdfunding.

And it’s completely legal. You showcase your million-dollar idea. And provide a glimpse of your future product.

Then ask for donations from random people, mainly on a website, and people give you money. This is the value of giving.

How to create a donation page on website?

To accept donations, you can either create a donation page or add a donate button to your WordPress website.

Let me show you an easy process of setting up a donation webpage for your LLC in just 5 steps. Chances are, you are halfway there.

For this, we are going to use a simple WordPress plugin, Paymattic. We are going to use the fastest website builder site, WordPress.

Step 1: Go to wordpress.com from your browser and create a free website

Step 2: Install the Paymattic plugin and activate it

You can download the Paymattic Free plugin from here. 👇

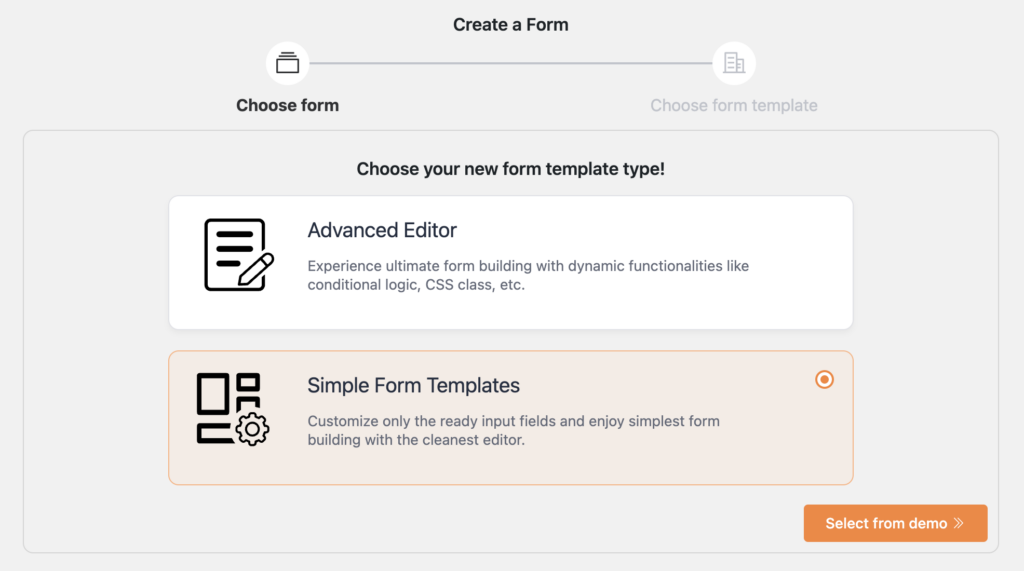

Step 3: Go to the plugin and press “Create Form“

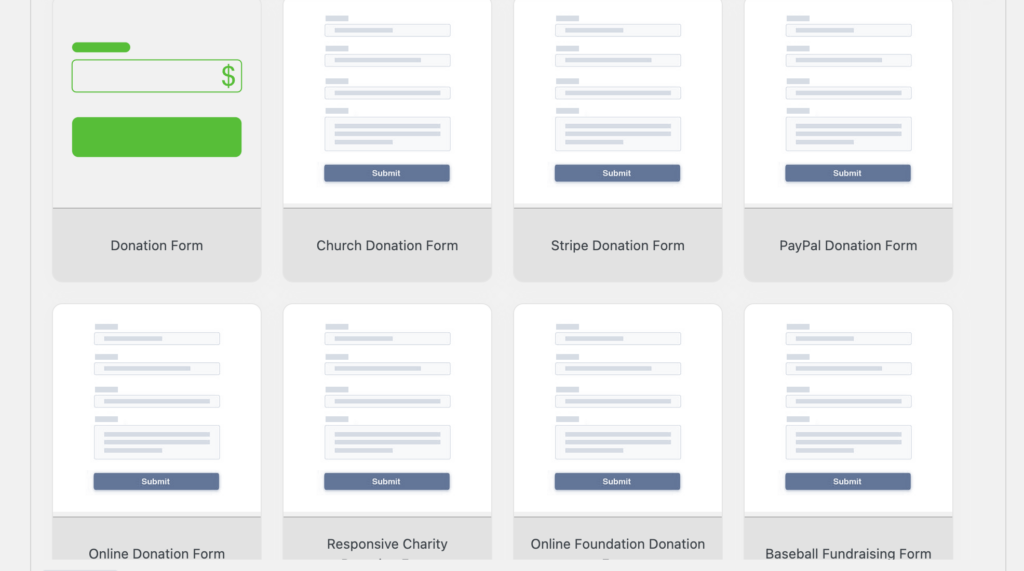

Step 4: Select your desired donation forms from multiple templates.

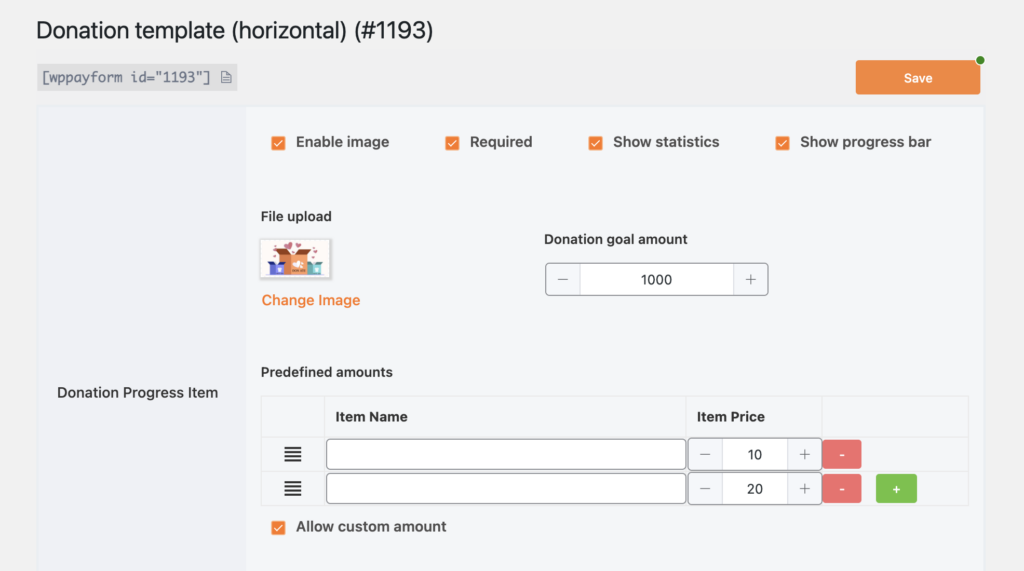

Step 5: Customize if you want, and you are good to go.

In closing

Can an LLC accept donations? Yes. This is how an LLC can save a substantial amount of money during its takeoff phase. Sometimes the donation can save the company itself.

It might seem confusing, how to accept donations without being a nonprofit. But building a donation webpage has always been the smartest way.

Thank you!

Also, learn how to create a fundraising website.

Join the thousands already enjoying Paymattic Pro!

Mahfuzur Rahman Nafi

Mahfuzur Rahman Nafi is a Marketing Strategist at WPManageNinja. With 4 years of experience in Product Marketing, he has developed marketing strategies, launched products, written content, and published websites for WordPress products. In his free time, he loves to read geeky stuffs.

Leave a Reply