2D Payment Gateway: Simplifying Online Transactions

Whether you offer a 3D or 2D payment gateway to your online store, consumers always want the fastest but most secure transaction.

Customers are always pressing on. So you’ve got to cope with this and try your best to provide the simplest solution.

According to Statista, the total transaction value in the digital payments market is projected to reach US$11.55 trillion in 2024. Various types of online payment gateways will be involved to make this happen.

So in this article, we’ll talk about 2D payment gateways, exploring their features, benefits, and what makes them different from 3D payment gateways.

What is a 2D payment gateway?

A 2 Dimensional Secure, also known as 2D Secure payment gateway, is the simplest form of payment authentication that requires the least amount of information to complete any online transaction.

Without any additional security check or entering any OTP, consumers can pay by inputting their basic card details, like their card number, expiration date, and CVV number.

2D payment gateways like PayPal, Stripe, PayU, and Braintree are widely popular because of the convenience they bring.

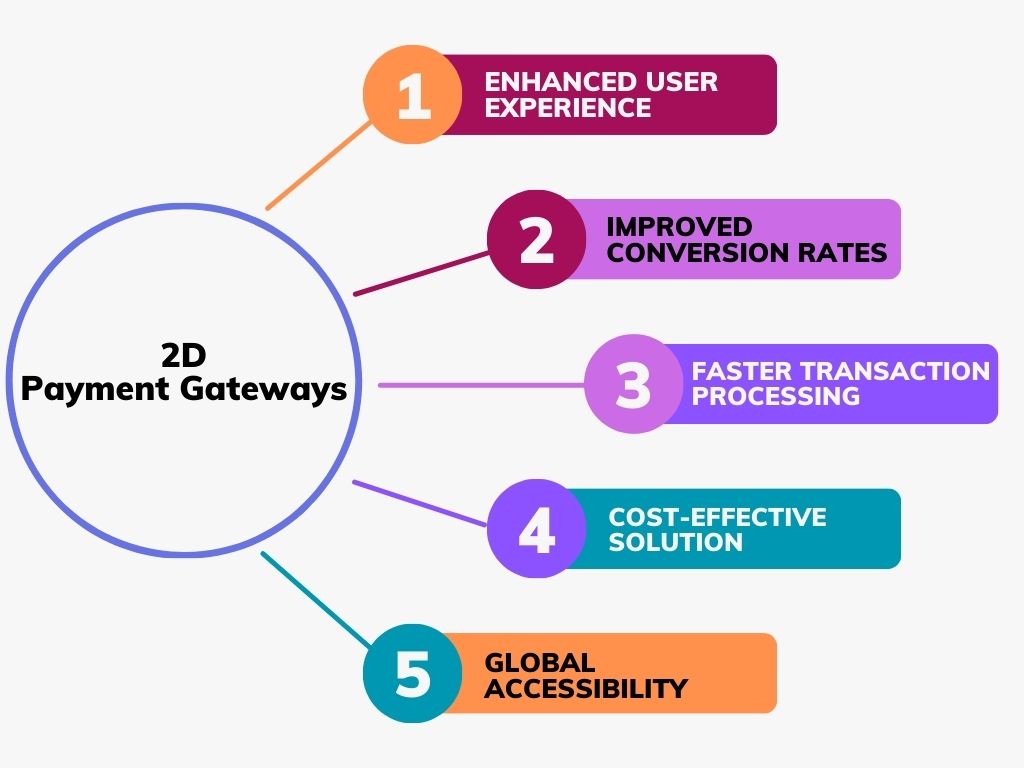

Benefits of 2D payment gateways

With seamless checkout experiences and swift transaction processing, 2D payment gateways empower businesses to enhance customer satisfaction and boost sales. It eliminates the need for additional authentication and makes payment processing effortless.

Let’s have a look at what it brings to your businesses:

- Enhanced user experience: 2D payment gateways offer a seamless and user-friendly checkout experience for customers, allowing them to complete transactions quickly without the hassle of additional authentication steps.

- Improved conversion rates: By streamlining the payment process and reducing friction during checkout, it can help businesses increase their conversion rates and drive sales.

- Faster transaction processing: With 2D payment gateways, transactions are processed rapidly, enabling businesses to receive payments promptly and improve cash flow.

- Cost-effective solution: Compared to 3D payment gateways, which may involve higher transaction fees and additional authentication costs, 2D payment gateways offer a more cost-effective payment processing solution for businesses of all sizes.

- Global accessibility: 2D payment gateways support transactions in multiple currencies and cater to customers worldwide, helping businesses expand their reach and tap into new markets.

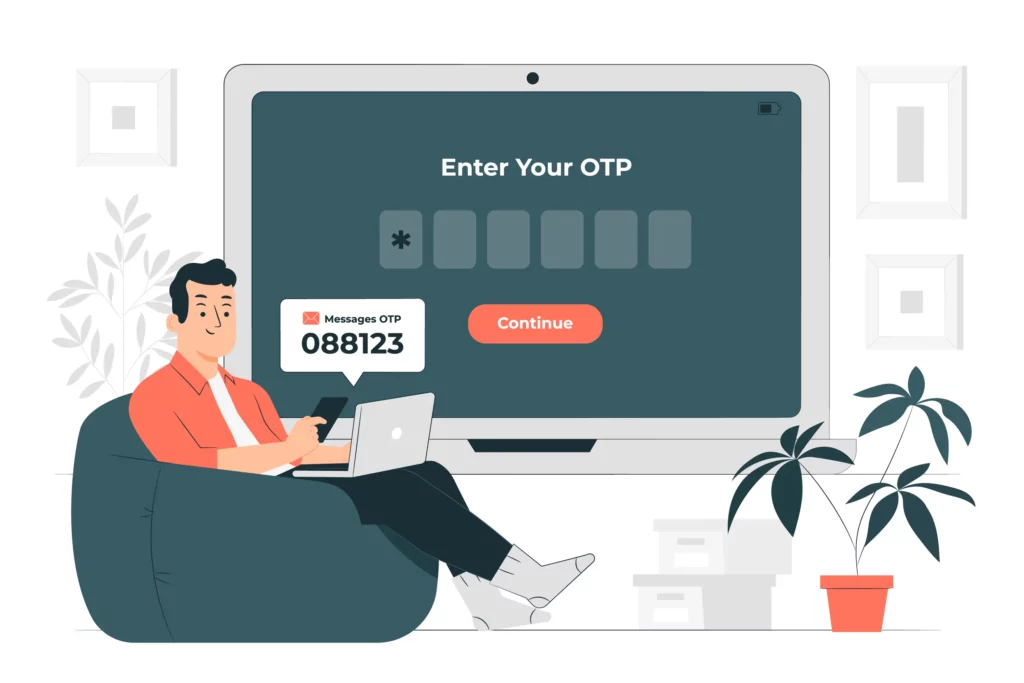

Differences between 2D and 3D payment gateways

While both 2D and 3D payment gateways facilitate online transactions, there are some dissimilarities in terms of authentication methods and security features. The key difference is receiving OTP through SMS or email.

Where 2D payment gateways allow you to complete your transactions by just inputting the basic card information, in 3D payment methods you’ve got to input the OTP in addition to the card details to make your payment.

The 2D method makes the process smoother and faster, whereas 3D payments are also quick, but you may have to wait for a longer period of time as sometimes the OTP does not arrive in real-time due to network issues.

Which can easily irritate a customer and lead them to abandon the purchase as well.

3D payment gateways are more secure as they’ve got an extra layer of security, but that doesn’t mean 2D payments are not secure at all. Most of them are PCI-DSS compliant and have end-to-end data encryption systems.

The extra verification of 3D payment systems may provide a less user-friendly experience for users, but they offer peace of mind by protecting them from potential fraudulent activities. Which is applicable for businesses and customers both.

Conversely, with 2D payment systems, the absence of such verification leaves users vulnerable to the risks of fraudulent transactions.

Pro Tip: Security Measures You Should Know Before Using a Global Payment Solution

Users are always under a security threat with 2D payment gateways. Because if someone’s card gets stolen or the details get revealed, which is not a tough deal, the thief can easily misuse it in any shop that uses a 2D payment processor.

But it can’t be done in any online shop that uses a 3D payment gateway.

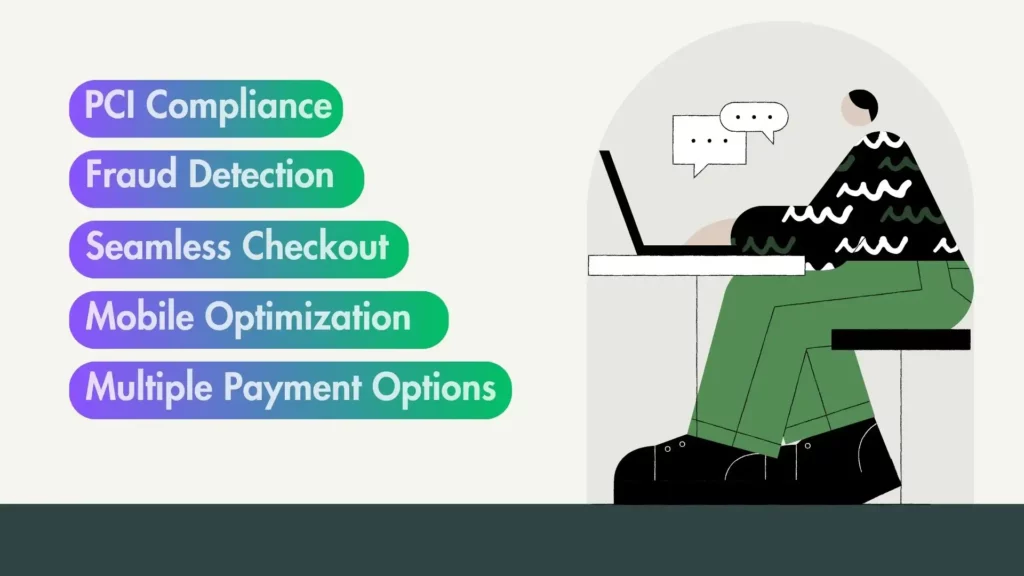

Best practices for 2D payment gateways

Implementing 2D payment methods effectively requires adherence to several best practices that ensure a smooth and secure transaction. Here are some key points to follow if you want to use 2D payment:

- PCI compliance: Ensure using a payment gateway that it is in compliance with PCI-DSS requirements to protect cardholder data and maintain the trust of your customers.

- Fraud detection and prevention: Because 2D payment gateways are less secure than 3D payment gateways, so utilize extra fraud protection tools like ReCAPTCHA and other algorithms to monitor transactions in real-time and identify suspicious activities.

To avoid additional protection costs, WordPress plugins like Paymattic offer free integration with multiple security tools, like ReCAPTCHA, Honeypot, and Cloudflare.

Read more: WordPress Spam Protection with Paymattic – Honeypot, Captcha & Turnstile

- Seamless checkout experience: Optimize the checkout process for simplicity and efficiency. Minimize the number of steps required for customers to complete transactions to reducing cart abandonment rates.

- Mobile optimization: Ensure that your 2D payment gateway is compatible with mobile devices and offers a seamless payment experience for customers accessing your website from smartphones and tablets.

- Multiple payment options: Provide customers with a variety of payment options, including credit/debit cards, digital wallets, and alternative payment methods, to accommodate diverse preferences and increase conversion rates.

Subscribe to Our Newsletter

Join the crowd for more promotional offers, product updates, fundraising tips and tricks.

How to integrate 2D payment gateways in WordPress

Integrating a payment gateway into WordPress is the easiest thing to do with Paymattic. It has a wide range of 11 payment gateways, including 2D and 3D payment methods. Just follow a few steps and start accepting payments on your website.

- Install the Paymattic plugin

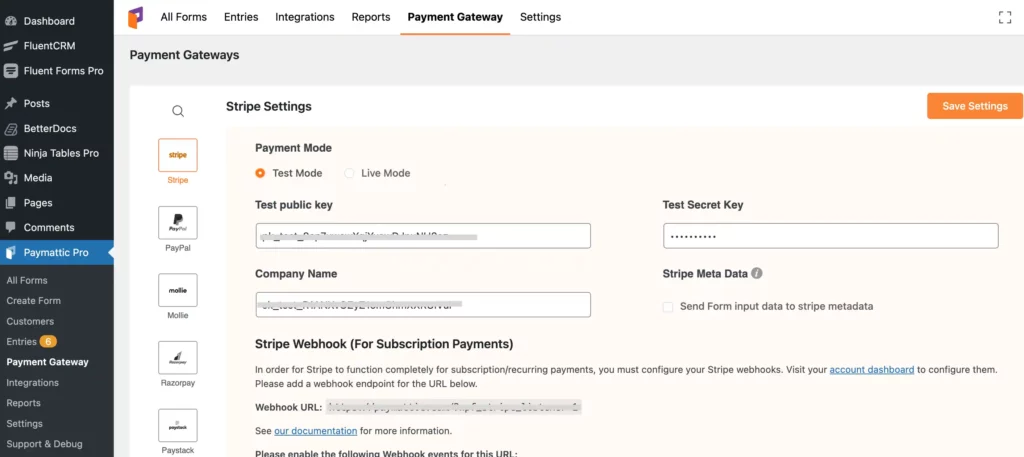

- Navigate to Paymattic (Pro) > Payment Gateway

- For example, choose Stripe

You’ll need the credentials here.

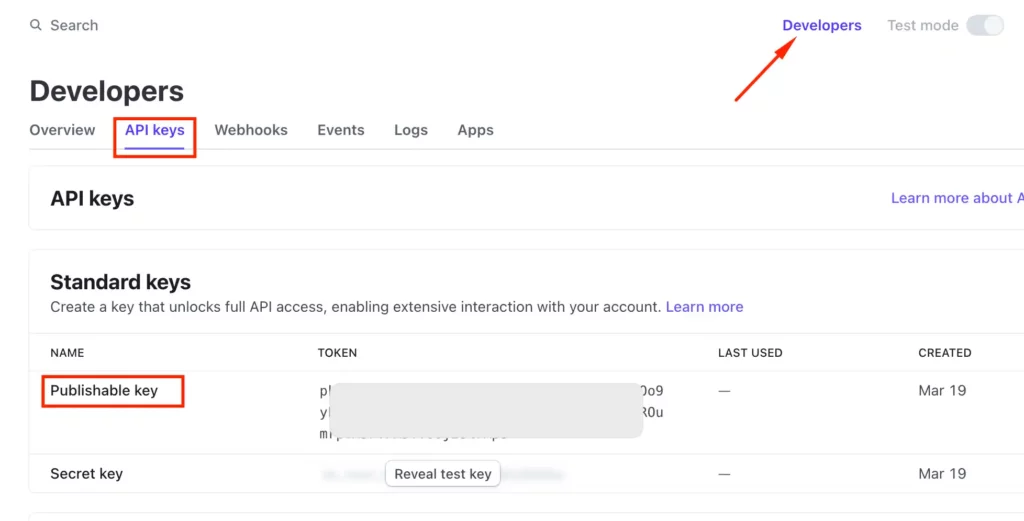

- Login to your Stripe dashboard > Developers section

- Navigate to API keys to get your Publishing key and Secret key

- Copy and paste the keys in the required field of Paymattic

- And finally, click on Save Settings

That’s all you need to configure a 3D or 2D secure payment gateway on your WordPress website with Paymattic. Follow the same procedure to integrate any other payment methods.

Ready to get started?

Experience WordPress payment and donation like never before. Try Paymattic now!

Wrapping up

In the rapidly evolving landscape of online transactions, choosing the right payment gateway can make all the difference for your business.

While 3D payment gateways offer an extra layer of security, 2D payments streamline the process, prioritizing speed and simplicity.

By understanding the nuances between them and implementing best practices, you can create a seamless and secure payment experience for your customers.

Try Paymattic & join the thousands already enjoying it.

![What’s New with WordPress Payments Plugin | Using Payment Tools in Paymattic [2023]](https://paymattic.com/wp-content/uploads/2022/06/Whats-new-with-WordPress-payments-1-1024x536.jpg)